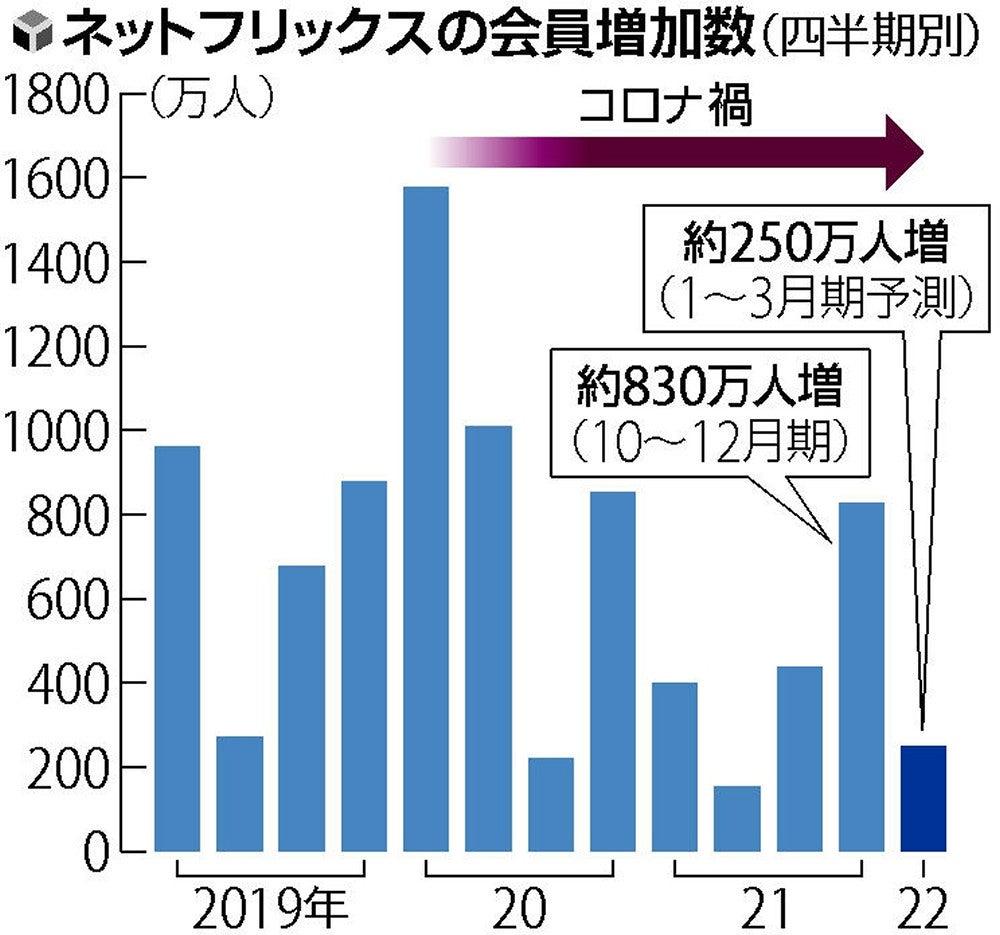

Netflix's share price plummeted 20% in after-hours trading on January 20th. The company's fourth-quarter results, announced yesterday, exceeded analysts' expectations in some respects, but showed a continuing downtrend in subscriber numbers. Netflix's global membership growth was 8.28 million in the fourth quarter, up 8.9% year-on-year, up from the October forecast of 8.5 million. It fell below. In addition, the growth rate decreased sharply compared to the 21.9% year-on-year recorded in the fourth quarter of 2020. As a result, Netflix's stock price temporarily fell 20% to $ 406.95 in after-hours trading. Meanwhile, earnings per share was $ 1.33, above analysts' expectations of 88 cents. Revenues reached analysts' expectations of $ 7.7 billion. Netflix has benefited from a surge in homes in the early days of the pandemic, but has recently faced a slowdown in subscriber growth, despite making the original content a big hit. In the third quarter, despite two-thirds of subscribers watching Squid Game, there were 4.4 million new subscribers, of which only 70,000 were from the United States and Canada. rice field. Last week, the company raised viewing fees in these regions. Netflix expects a $ 7.9 billion increase in revenue in the first quarter of 2022, which will partially reflect the increase in viewing fees, but will increase for existing members. Is given 30 days to apply. The company also expects 2.5 million new subscribers next quarter, down 1.48 million from the year-ago quarter. Netflix showed its strengths in Google's list of the most searched terms in 2021. The company owns six of Google's 10 most searched dramas, with "Squid Game" and "Bridgerton" occupying first and second place. Also, two of the 10 most searched movies were the company's "Red Notice" and "Army of the Dead."

Mason Bissada